Are you standing at the crossroads of a CPA and an MBA, unsure of which path to tread?

You’re not alone.

Countless individuals find themselves in this dilemma, questioning which credential will catapult their careers to new heights.

But here’s the deal.

Before you take the leap and commit to either path, it’s essential to understand what each credential brings to the table. Getting a CPA vs MBA requires competitive exams, less higher education commitment, and possibly more money, but there are also downsides.

This comprehensive guide will help you dissect the CPA vs MBA debate, offering a granular comparison of both career paths. So, let’s dive right in and unravel the specifics of each option.

CPA Exam and Credential: A Deep Dive

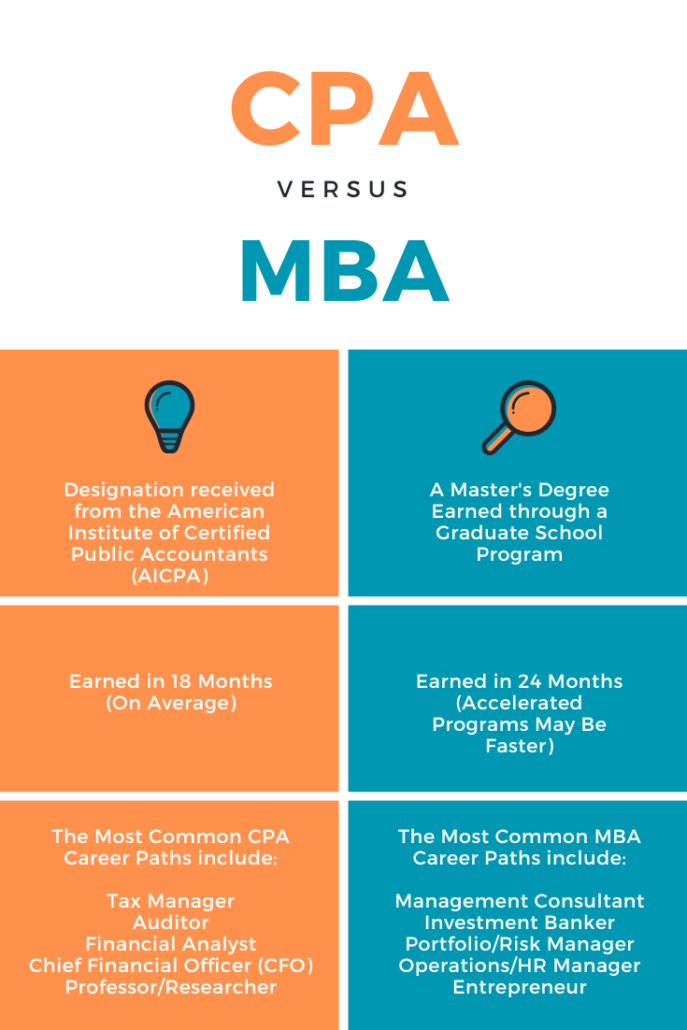

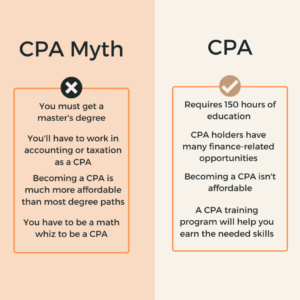

The Certified Public Accountant (CPA) credential is one of the most respected designations in the financial world. To obtain a CPA license, candidates must complete a rigorous process that includes passing the CPA exam, fulfilling educational requirements, and gaining work experience.

CPA Exam

The CPA exam is divided into four sections, namely, Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Candidates must pass all sections within an 18-month window to qualify for a CPA license.

CPA License

Individual states grant a CPA license, and license requirements may vary from state to state. Generally, it involves completing 150 semester hours of undergraduate and/or graduate coursework, passing the CPA exam, and gaining relevant work experience.

MBA Degree and Programs: An Overview

A Master of Business Administration (MBA) is a graduate-level degree that covers a wide range of business disciplines, including finance, marketing, human resources, and operations management. MBA programs can be full-time, part-time, or accelerated and are offered by both public and private institutions.

MBA Programs and MBA Degree Program Options

There are various types of MBA programs, such as the traditional two-year full-time program, part-time programs for working professionals, and accelerated programs that can be completed within a year. Additionally, some schools offer specialized MBA programs tailored to specific industries or career paths.

There was once this ideal that MBAs are elitist. However, things are changing, and diversity has become a big push for many universities. This is especially true due to the recent trend of college admissions consultants helping nontraditional students break through into the best MBA programs in the US.

CPA vs MBA: Comparing Career Paths, Prospects, and Salaries

When it comes to choosing between a CPA and an MBA academic degree, it’s essential to consider your career interests, goals, and the potential opportunities each path provides.

Career Paths and Opportunities

A CPA license primarily leads to careers in accounting, auditing, taxation, and financial advisory roles. For example, typical job titles for those who become certified public accountants include tax advisor, financial advisor, forensic accountant, and chief financial officer. On the other hand, an MBA degree opens up a multitude of career paths, from management consulting and investment banking to marketing manager and human resource manager positions.

Career Prospects and Growth

Both CPA and MBA credentials offer excellent career prospects, with CPAs being in high demand in accounting firms and the corporate world. At the same time, MBA graduates in accounting are sought after by various industries for their versatile skills and knowledge. As a result, certified public accountant roles will see a 7% uptick from 2023 forward, while an MBA graduate will see an 11% rise in related careers.

Average Salary and Income

Salaries for both CPAs and MBAs can vary widely based on factors such as experience, location, and the size of the employing organization.

For CPAs, the range is between $70,235 and $461,014. MBA holder new hires, on average, bring in around $115,000.

It’s important to remember both career paths generally offer competitive compensation packages, with CPAs and MBA graduates earning well above the national average for many job titles. This is especially true when you make continuing education a priority for you.

CPA vs MBA: Which One is Right for You?

Ultimately, choosing between a CPA and an MBA will depend on your career goals, interests, and the specific skills you wish to develop. For example, some college students choose an MBA because they want to enter a master’s degree program that will give them a broad overview of business administration.

On the other hand, those choosing a CPA vs MBA might have decided that going the certification exam route is better because they’ve already chosen the accounting profession. For these CPA candidates, another degree completion is optional.

CPA: For the Finance Niche

If you’re passionate about accounting, taxation, or financial analysis and want to work in a specialized finance niche, a CPA license could be the perfect choice for you. Career opportunities in the finance niche are perfect for CPA holders.

MBA: For the Business Environment

On the other hand, if you’re interested in a broader range of business disciplines and aspire to become a leader in the corporate world, an MBA degree might be a better fit. This is especially true if you like variety and want a lot of career choices.

For example, an MBA degree holder can be an operations manager, an investment banker, or a chief information officer. They can even work in corporate governance.

Why Not Both? The Best of Both Worlds

For some individuals, pursuing both a CPA license and an MBA degree can provide a unique combination of skills and knowledge that sets them apart in the job market.

This dual qualification can be particularly beneficial in roles that require both deep financial expertise and broad business acumens, such as a Chief Financial Officer or a management consultant. Of course, different career paths come with each, but earning an MBA and a CPA designation can give you a “best of both worlds” advantage.

The CPA-MBA Advantage

If you’re someone with a knack for numbers and a desire to lead in the business world, then earning both an MBA degree and a CPA license can be a golden ticket. Combining the specialized financial accreditation awarded through the CPA exam with an MBA program’s general business and leadership training will prepare you to excel in high-level roles in any business environment.

Taking the Leap: Pursuing Both a CPA License and an MBA Degree

The journey to earning a CPA license and an MBA degree will be challenging, but with the right planning and dedication, it’s more than achievable. Start by obtaining an undergraduate degree, preferably in a field related to business or accounting. Then, you can take CPA prep courses while also preparing for your MBA admissions.

Here, enlisting the help of the best MBA admissions consultants can be a game-changer. They can provide invaluable insights into the MBA application process, help you choose the right MBA programs, and guide you in crafting compelling application materials. They can also help you with the private versus public institution decision.

Conclusion

In the debate of CPA vs MBA, there’s no one-size-fits-all answer. Each path offers its own unique benefits and challenges, and the right choice will depend on your individual career goals, interests, and the specific skills you wish to develop. Whether you choose the specialized route of a CPA, the broad business focus of an MBA, or decide to tackle both, remember that both paths lead to rewarding and successful careers in the world of business and finance.

CPA vs MBA: FAQs

Absolutely! Many MBA programs welcome students from various academic backgrounds. Having an MBA can also be beneficial when preparing for the CPA exam, as the coursework can help reinforce accounting concepts.

The duration can vary. Most full-time MBA programs take two years to complete, while accelerated or part-time MBA programs can take anywhere from one to three years, respectively. On the other hand, passing the CPA exam and fulfilling the work experience requirements for licensure can take several years.

The average salary can vary widely based on factors such as location, industry, and job role. However, both CPAs and MBA graduates typically earn salaries well above the national average.

Yes, you can. Many work while studying for the CPA exam or pursuing an MBA degree. However, balancing work, study, and personal commitments can be challenging and requires excellent time management skills.

Both have their challenges. The CPA exam is known for its difficulty and low pass rates, while an MBA program can be demanding in terms of the volume and complexity of coursework.

It can be, depending on your career goals. Having both credentials can open up a wider range of career opportunities and potentially lead to higher earnings.

An MBA admission consultant provides personalized advice to strengthen your application, prepare for interviews, and choose the right schools for your career path, thereby increasing your chances of admission into top business schools.

Definitely! A CPA credential equips you with advanced financial accounting and business law skills. Whether you’re in a CPA firm, an accounting firm, or a finance department, a CPA certification can open up roles such as financial advisor and operations manager.

Yes, a bachelor’s degree is typically required for both. For example, CPA exams usually require 150 semester hours of education with specific coursework in accounting and business. In addition, MBA programs generally demand a bachelor’s degree for admission.

Yes, many MBA programs offer flexible schedules for working professionals. Working in an accounting or CPA firm while pursuing an MBA can enhance your practical experience and potentially fulfill the work experience requirement for CPA certification. But remember, balancing work and studies demands careful planning.

Bryce Welker is an active speaker, blogger, and regular contributor to Forbes, Inc.com, and Business.com where he shares his knowledge to help others boost their careers. Bryce is the founder of more than 20 test prep websites that help students and professionals pass their certification exams.